All Categories

Featured

Table of Contents

There is no payout if the policy ends prior to your death or you live beyond the policy term. You may be able to renew a term plan at expiry, yet the premiums will be recalculated based on your age at the time of renewal.

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance policy Fees three decades old $18 $15 40 years old $28 $23 half a century old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for guys and women in superb health. On the other hand, here's a take a look at rates for a $100,000 entire life plan (which is a kind of long-term policy, implying it lasts your life time and consists of money value).

The reduced danger is one variable that allows insurance providers to charge reduced premiums. Rate of interest prices, the financials of the insurer, and state laws can additionally impact costs. Generally, firms usually offer far better rates at the "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the quantity of insurance coverage you can obtain for your premium bucks, term life insurance has a tendency to be the least expensive life insurance policy.

He purchases a 10-year, $500,000 term life insurance policy with a premium of $50 per month. If George passes away within the 10-year term, the policy will pay George's beneficiary $500,000.

If George is detected with an incurable health problem throughout the initial plan term, he possibly will not be qualified to restore the policy when it ends. Some plans offer ensured re-insurability (without evidence of insurability), yet such attributes come with a higher cost. There are a number of sorts of term life insurance coverage.

Typically, a lot of business use terms ranging from 10 to thirty years, although a few deal 35- and 40-year terms. Level-premium insurance has a fixed month-to-month settlement for the life of the plan. Many term life insurance policy has a level costs, and it's the kind we've been describing in the majority of this post.

Proven Term Life Insurance With Accelerated Death Benefit

Term life insurance policy is attractive to youngsters with children. Parents can get substantial insurance coverage for an inexpensive, and if the insured passes away while the plan holds, the household can count on the survivor benefit to replace lost earnings. These policies are additionally well-suited for people with growing families.

Term life policies are optimal for individuals who desire considerable protection at a low expense. People that own whole life insurance coverage pay more in premiums for much less insurance coverage however have the safety of knowing they are shielded for life.

The conversion motorcyclist must enable you to convert to any kind of permanent policy the insurer supplies without restrictions. The main attributes of the rider are keeping the initial health and wellness rating of the term policy upon conversion (even if you later have health issues or end up being uninsurable) and making a decision when and just how much of the protection to convert.

Of training course, general costs will raise significantly since whole life insurance coverage is much more costly than term life insurance. Medical conditions that establish during the term life period can not trigger costs to be boosted.

Entire life insurance coverage comes with significantly higher month-to-month costs. It is meant to offer protection for as long as you live.

Secure A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Insurance policy firms established an optimum age limitation for term life insurance plans. The premium likewise climbs with age, so an individual aged 60 or 70 will pay substantially more than someone years more youthful.

Term life is rather comparable to car insurance policy. It's statistically not likely that you'll require it, and the costs are cash down the drain if you do not. But if the most awful occurs, your household will receive the benefits.

One of the most preferred kind is now 20-year term. The majority of business will certainly not offer term insurance to a candidate for a term that ends previous his or her 80th birthday. If a plan is "renewable," that means it continues active for an extra term or terms, as much as a defined age, even if the health of the guaranteed (or other factors) would trigger him or her to be declined if he or she got a brand-new life insurance coverage plan.

So, premiums for 5-year renewable term can be degree for 5 years, then to a brand-new price showing the new age of the insured, and more every 5 years. Some longer term policies will certainly assure that the costs will certainly not enhance throughout the term; others don't make that assurance, making it possible for the insurer to increase the price during the plan's term.

This implies that the policy's proprietor deserves to alter it into an irreversible kind of life insurance policy without extra proof of insurability. In most sorts of term insurance policy, including homeowners and auto insurance coverage, if you have not had a case under the policy by the time it expires, you obtain no reimbursement of the premium.

Cost-Effective Joint Term Life Insurance

Some term life insurance customers have actually been dissatisfied at this result, so some insurers have created term life with a "return of costs" feature. what is direct term life insurance. The premiums for the insurance policy with this feature are frequently dramatically greater than for plans without it, and they typically need that you keep the policy in pressure to its term otherwise you surrender the return of premium benefit

Degree term life insurance policy costs and fatality benefits continue to be regular throughout the plan term. Level term life insurance coverage is commonly a lot more economical as it does not develop money value.

Budget-Friendly Level Term Life Insurance Meaning

While the names frequently are used interchangeably, level term coverage has some essential differences: the costs and survivor benefit stay the exact same for the period of coverage. Level term is a life insurance coverage policy where the life insurance coverage premium and survivor benefit continue to be the exact same throughout of insurance coverage.

Latest Posts

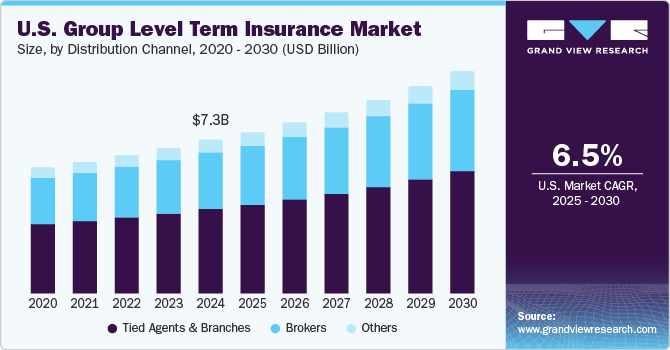

Top Group Term Life Insurance Tax

Mortgage Protection Insurance Coverage

First Time Buyer Life Insurance