All Categories

Featured

Table of Contents

That generally makes them a more budget-friendly option for life insurance coverage. Lots of individuals get life insurance policy coverage to assist financially secure their loved ones in situation of their unforeseen fatality.

Or you may have the option to convert your existing term insurance coverage right into an irreversible plan that lasts the remainder of your life. Various life insurance policy plans have potential advantages and disadvantages, so it is very important to recognize each prior to you choose to purchase a plan. There are several benefits of term life insurance policy, making it a popular selection for coverage.

As long as you pay the costs, your recipients will certainly receive the survivor benefit if you die while covered. That stated, it is necessary to note that most policies are contestable for 2 years which implies coverage can be retracted on death, needs to a misstatement be located in the application. Policies that are not contestable usually have a rated fatality advantage.

Costs are usually lower than whole life plans. With a degree term policy, you can choose your protection amount and the plan length. You're not secured right into a contract for the rest of your life. Throughout your policy, you never have to stress over the costs or survivor benefit amounts changing.

And you can't pay out your policy during its term, so you won't get any kind of financial advantage from your past insurance coverage. Similar to various other kinds of life insurance policy, the expense of a degree term plan depends on your age, protection needs, employment, way of life and health and wellness. Commonly, you'll locate much more budget friendly coverage if you're younger, healthier and much less risky to guarantee.

Tax-Free Guaranteed Issue Term Life Insurance

Because degree term premiums remain the same for the duration of coverage, you'll recognize specifically how much you'll pay each time. Level term protection likewise has some adaptability, allowing you to tailor your policy with added features.

You might have to satisfy details problems and credentials for your insurance firm to pass this cyclist. In addition, there may be a waiting period of approximately 6 months prior to taking effect. There likewise might be an age or time restriction on the protection. You can add a child cyclist to your life insurance coverage plan so it also covers your children.

The fatality benefit is commonly smaller, and insurance coverage generally lasts till your child turns 18 or 25. This biker may be a more cost-effective way to assist ensure your kids are covered as bikers can often cover numerous dependents at once. As soon as your kid ages out of this protection, it may be feasible to convert the rider into a new plan.

The most typical type of permanent life insurance policy is entire life insurance coverage, but it has some essential distinctions compared to level term protection. Here's a fundamental introduction of what to consider when comparing term vs.

Trusted Level Term Life Insurance Meaning

Whole life insurance lasts insurance coverage life, while term coverage lasts insurance coverage a specific periodCertain The costs for term life insurance coverage are typically reduced than entire life insurance coverage.

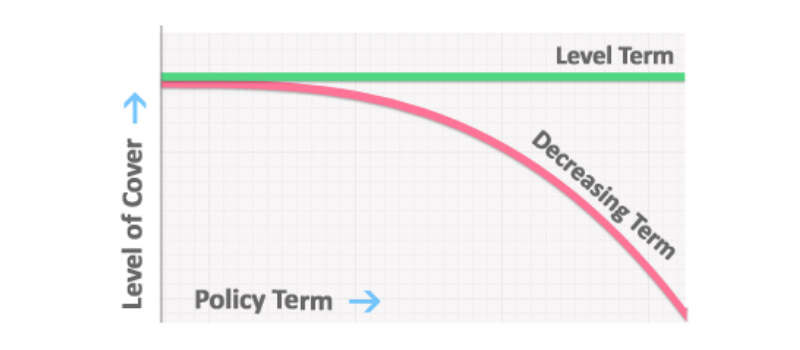

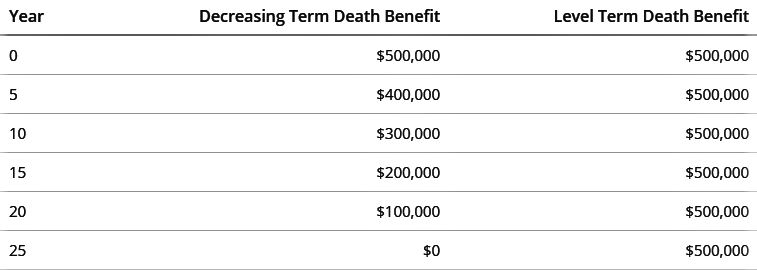

One of the primary attributes of level term protection is that your premiums and your fatality advantage do not change. You might have protection that begins with a death advantage of $10,000, which might cover a mortgage, and after that each year, the fatality advantage will certainly decrease by a set quantity or percent.

Because of this, it's typically a more budget-friendly sort of level term insurance coverage. You may have life insurance policy with your employer, but it may not suffice life insurance for your requirements. The primary step when purchasing a policy is identifying just how much life insurance coverage you need. Consider aspects such as: Age Family size and ages Employment condition Income Financial debt Way of living Expected last expenditures A life insurance policy calculator can help determine just how much you require to start.

After selecting a plan, finish the application. For the underwriting process, you may have to offer general individual, health, way of living and work info. Your insurance firm will certainly figure out if you are insurable and the risk you might present to them, which is shown in your premium expenses. If you're approved, sign the documents and pay your initial costs.

Cost-Effective Level Term Life Insurance

You might want to upgrade your recipient info if you have actually had any kind of considerable life changes, such as a marriage, birth or separation. Life insurance policy can sometimes feel complex.

No, degree term life insurance policy doesn't have money worth. Some life insurance policy plans have a financial investment function that permits you to construct cash money value with time. A part of your costs settlements is alloted and can make rate of interest with time, which grows tax-deferred throughout the life of your insurance coverage.

These policies are frequently substantially much more pricey than term coverage. If you reach completion of your plan and are still to life, the coverage ends. You have some options if you still desire some life insurance protection. You can: If you're 65 and your protection has actually run out, as an example, you might intend to purchase a brand-new 10-year degree term life insurance policy policy.

Best Decreasing Term Life Insurance Is Often Used To

You might be able to transform your term protection into an entire life plan that will certainly last for the rest of your life. Numerous kinds of degree term plans are convertible. That indicates, at the end of your protection, you can convert some or all of your policy to whole life insurance coverage.

Level term life insurance policy is a plan that lasts a collection term usually in between 10 and three decades and includes a level fatality advantage and degree premiums that stay the very same for the whole time the plan is in effect. This implies you'll recognize specifically just how much your settlements are and when you'll need to make them, permitting you to budget plan appropriately.

Degree term can be a great alternative if you're seeking to purchase life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance Measure Research, 30% of all grownups in the United state demand life insurance and don't have any kind of type of plan. Level term life is foreseeable and budget-friendly, which makes it one of one of the most prominent sorts of life insurance policy.

Latest Posts

Funeral Protection Plan

Cheapest Funeral Cover For Parents

Final Expense Insurance Florida