All Categories

Featured

Table of Contents

That commonly makes them an extra cost effective option forever insurance policy coverage. Some term plans may not keep the costs and fatality profit the exact same gradually. You do not intend to mistakenly believe you're purchasing degree term insurance coverage and after that have your survivor benefit adjustment later. Many individuals get life insurance policy protection to aid economically safeguard their liked ones in case of their unanticipated fatality.

Or you might have the alternative to convert your existing term insurance coverage right into a permanent plan that lasts the remainder of your life. Various life insurance plans have possible benefits and downsides, so it's crucial to comprehend each prior to you make a decision to buy a policy.

As long as you pay the premium, your beneficiaries will certainly receive the fatality benefit if you die while covered. That claimed, it is necessary to keep in mind that many policies are contestable for 2 years which indicates insurance coverage could be retracted on fatality, should a misrepresentation be located in the app. Policies that are not contestable typically have a rated survivor benefit.

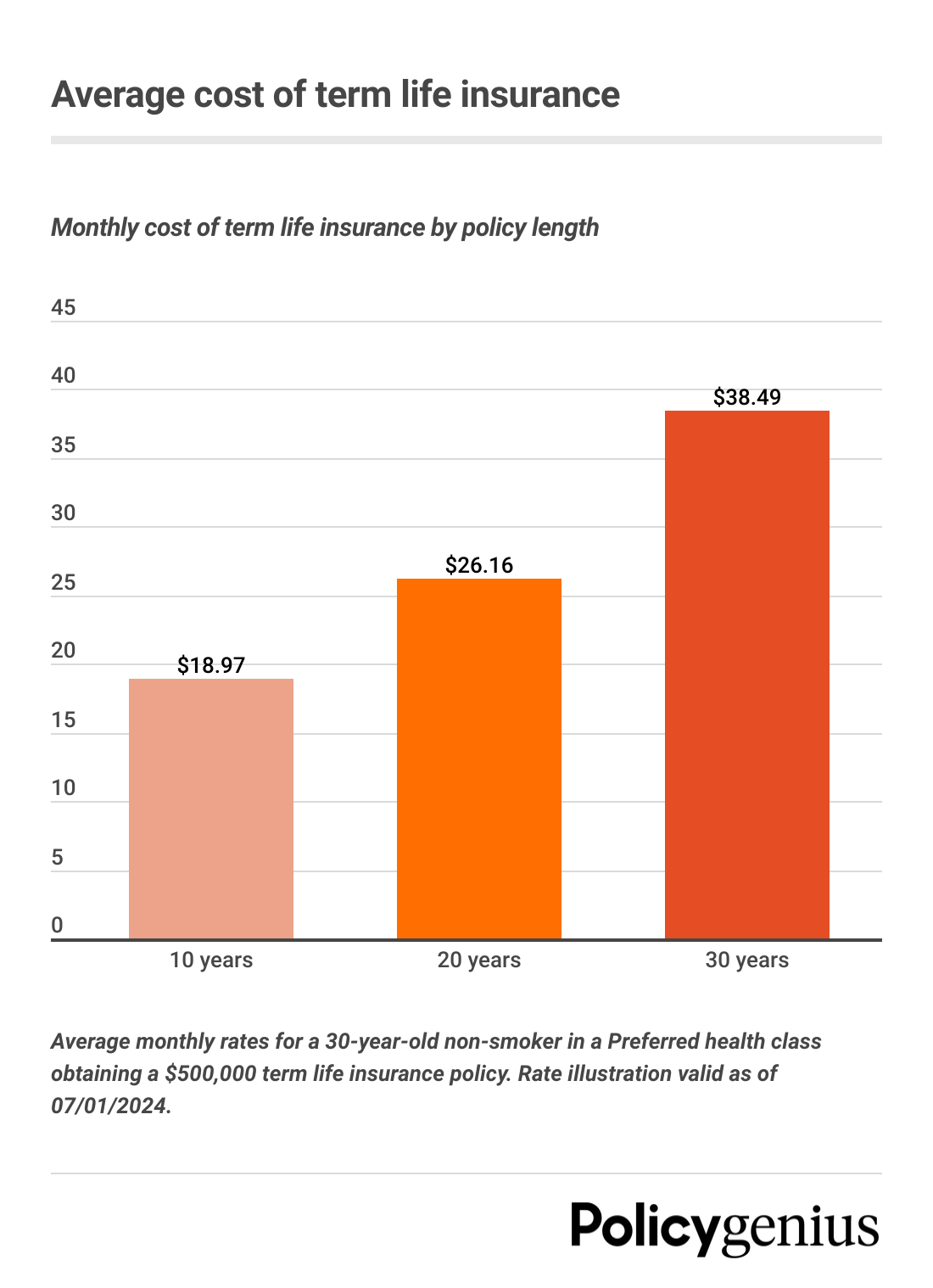

Premiums are normally less than whole life plans. With a level term policy, you can choose your protection amount and the plan length. You're not locked right into a contract for the remainder of your life. Throughout your plan, you never have to bother with the premium or death advantage quantities altering.

And you can't pay out your policy throughout its term, so you won't receive any kind of economic benefit from your previous protection. As with various other types of life insurance policy, the cost of a degree term policy depends on your age, protection needs, work, lifestyle and health. Usually, you'll find extra inexpensive insurance coverage if you're younger, healthier and less risky to guarantee.

Expert Increasing Term Life Insurance

Considering that level term costs remain the same for the duration of protection, you'll recognize exactly how much you'll pay each time. Level term coverage also has some versatility, permitting you to tailor your policy with added features.

You might need to satisfy details problems and certifications for your insurance firm to pass this motorcyclist. Additionally, there may be a waiting duration of as much as six months before working. There also can be an age or time frame on the insurance coverage. You can include a child cyclist to your life insurance coverage policy so it likewise covers your youngsters.

The death benefit is usually smaller, and insurance coverage generally lasts up until your kid turns 18 or 25. This cyclist might be a much more affordable way to assist ensure your youngsters are covered as bikers can commonly cover several dependents at once. When your youngster ages out of this protection, it might be possible to transform the motorcyclist into a new policy.

The most typical kind of irreversible life insurance coverage is whole life insurance policy, but it has some vital distinctions compared to level term coverage. Here's a standard introduction of what to think about when contrasting term vs.

Sought-After Term Life Insurance With Accelerated Death Benefit

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodCertain The premiums for term life insurance coverage are typically lower than entire life protection.

Among the main attributes of level term protection is that your costs and your survivor benefit don't change. With decreasing term life insurance policy, your costs stay the exact same; however, the death advantage quantity obtains smaller sized in time. For instance, you may have coverage that starts with a survivor benefit of $10,000, which could cover a home loan, and afterwards every year, the survivor benefit will reduce by a collection quantity or portion.

As a result of this, it's often a more affordable kind of degree term insurance coverage. You might have life insurance coverage through your employer, however it may not be adequate life insurance policy for your needs. The primary step when buying a policy is identifying just how much life insurance coverage you need. Think about factors such as: Age Family size and ages Work condition Income Financial obligation Way of living Expected final costs A life insurance policy calculator can help determine just how much you require to start.

After choosing a policy, complete the application. For the underwriting procedure, you might need to provide general personal, wellness, way of living and work details. Your insurer will certainly establish if you are insurable and the risk you may provide to them, which is shown in your premium prices. If you're accepted, sign the paperwork and pay your very first premium.

Long-Term Term Life Insurance With Accelerated Death Benefit

Finally, think about organizing time each year to evaluate your plan. You might wish to update your beneficiary details if you have actually had any kind of substantial life adjustments, such as a marital relationship, birth or separation. Life insurance policy can sometimes feel challenging. You don't have to go it alone. As you explore your options, take into consideration discussing your requirements, wants and worries with a monetary specialist.

No, level term life insurance policy doesn't have cash worth. Some life insurance policy policies have a financial investment function that enables you to build cash money value over time. A portion of your costs settlements is alloted and can gain passion over time, which expands tax-deferred during the life of your coverage.

These policies are usually considerably a lot more pricey than term coverage. If you get to completion of your plan and are still active, the protection ends. You have some choices if you still want some life insurance protection. You can: If you're 65 and your coverage has gone out, for instance, you might desire to get a brand-new 10-year degree term life insurance policy plan.

Renowned Level Term Life Insurance Definition

You may have the ability to convert your term protection into a whole life plan that will last for the remainder of your life. Numerous kinds of level term policies are exchangeable. That means, at the end of your insurance coverage, you can convert some or every one of your policy to entire life protection.

Level term life insurance is a policy that lasts a collection term generally between 10 and 30 years and comes with a level death benefit and degree premiums that stay the exact same for the whole time the plan is in impact. This indicates you'll know exactly how much your repayments are and when you'll have to make them, enabling you to spending plan appropriately.

Degree term can be a wonderful choice if you're looking to buy life insurance policy coverage for the first time. According to LIMRA's 2023 Insurance Measure Research Study, 30% of all adults in the U.S. requirement life insurance coverage and do not have any kind of plan. Degree term life is foreseeable and economical, which makes it among one of the most preferred sorts of life insurance policy.

Latest Posts

Funeral Protection Plan

Cheapest Funeral Cover For Parents

Final Expense Insurance Florida